Del Rey Urban & Sutter Securities Group bring you the California Flip Fund.

Regulation D Offering

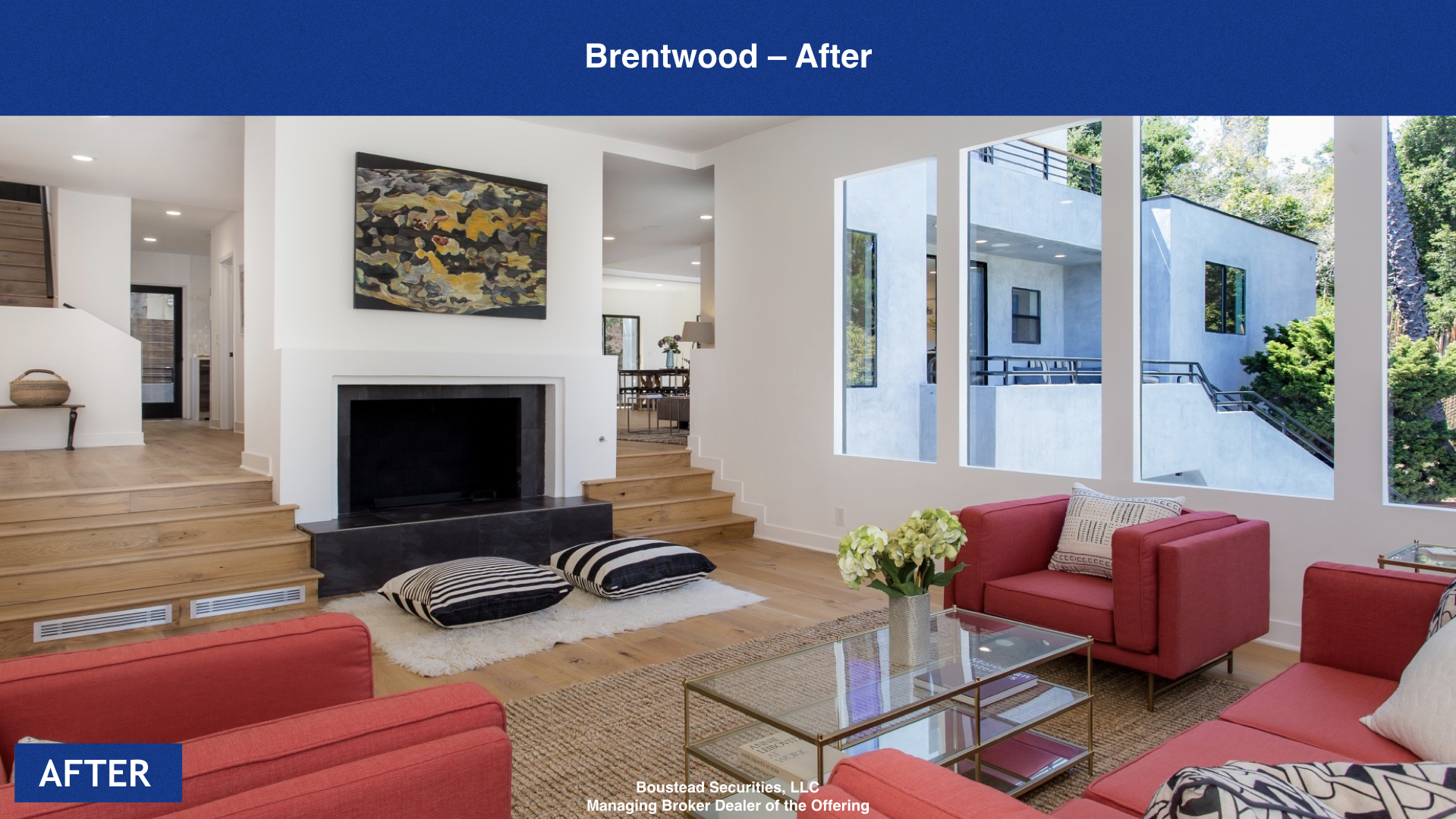

Valo California Flip Fund, LLC, managed by Valo Capital, LLC (“Valo”), has acquired a new renovation opportunity in the Los Feliz neighborhood of Los Angeles, CA. A core focus of Valo’s business plan is to acquire distressed properties that allow us to create value for our investors. The Hobart property was recently being renovated prior to a fire occurring that stopped construction. Valo’s business plan is to acquire the property, complete the repairs and remedy any damage to restore this beautiful modern Spanish renovation before putting it on the market to sell. The location of this property is highly sought after in Los Angeles with pride of ownership and walking distance to Griffith Park Observatory.

Property Stats

4 bedroom

4 bathroom

~4,000 square feet

Estimated Sales Price: $3,200,000

Will insider investments be accepted for this offering?*

Yes.

If yes, these are the names of the insiders that have invested or are expected to invest:

Del Rey Urban, LLC will be investing in this 506(c) offering. Scott Chaplan is the CEO at Del Rey Urban, LLC and is also the CEO of Valo Capital, LLC.

What is the maximum amount of investment that will be accepted from insiders?

Any above listed individual or entity may invest up to the maximum total investment amount sought in this offering unless otherwise disclosed. Additionally, any investment accepted from an insider will not count toward the offering's minimum contingency. The investment will only be reflected as a part of the total amount raised after the contingency has been reached.

Definitions:

Transactions for or on behalf of the Issuer or broker-dealer, their affiliates or associated persons (including control persons, officers, employees, and immediate family members thereof), or any entities through nominee accounts require disclosure.

-

“Affiliate” means a person that directly or indirectly, through one or more intermediaries, controls or is controlled by or is under common control with, the Issuer.

-

“Officer” means an Issuer's president, principal financial officer, principal accounting officer (or, if there is no such accounting officer, the controller), any vice-president of the Issuer in charge of a principal business unit, division or function (such as sales, administration or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions for the Issuer. Officers of the Issuer's parent(s) or subsidiaries shall be deemed officers of the Issuer if they perform such policy-making functions for the Issuer. In addition, when the Issuer is a limited partnership, officers or employees of the general partner(s) who perform policy-making functions for the limited partnership are deemed officers of the limited partnership. When the Issuer is a trust, officers or employees of the trustee(s) who perform policy-making functions for the trust are deemed officers of the trust.

-

“Immediate family” shall mean any child, stepchild, grandchild, parent, stepparent, grandparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, and shall include adoptive relationships.

-

“Control person” is a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with the issuer or broker/dealer

-

“Control” is the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a person, whether through the ownership of voting securities, by contract, or otherwise

* This offering will only close if the minimum offering contingency is fully met with non-insider purchases.

Certain principals of Valo Capital, LLC may make seed or ongoing investments in The California Flip Fund, LLC, among other future fund clients managed or advised by Valo Capital, LLC. Valo Capital, LLC may, in its sole discretion as an advisor, waive all management and other related fees from such investments.

Scott Chaplan founded the Urban Group of Companies following the recession during the early 1990s and transformed it into an integrated private equity and advisory services firm which has structured, financed, brokered, acquired, developed, rehabilitated and manages over $1 billion of multi-unit residential, mixed use, commercial and office properties throughout the United States. Many of these projects involve...

Expand BioScott Chaplan founded the Urban Group of Companies following the recession during the early 1990s and transformed it into an integrated private equity and advisory services firm which has structured, financed, brokered, acquired, developed, rehabilitated and manages over $1 billion of multi-unit residential, mixed use, commercial and office properties throughout the United States. Many of these projects involve historic buildings which have been rehabilitated to provide affordable housing with low-income communities.

Mr. Chaplan was a pioneer in developing environmentally sustainable projects within the inner-city. Leveraging his knowledge relating to the residents’ needs within the urban community, Mr. Chaplan created a comprehensive consulting business that assists organizations and individuals in low-income communities with developing essential and sustainable business and life skills. One positive outcome is the conversion of renters into buyers of Del Rey properties.

Mr. Chaplan serves on multiple for-profit and non-profit boards including Hayward Lumber Company, Forest Stewardship Council, Environmental Media Association and Pepperdine University School of Law Palmer Center for Entrepreneurship and Technology Law where he remains on the faculty as an adjunct professor. He is also a faculty member of Kaplan University.

Collapse Bio

Prior to joining the Urban Group of Companies and DRU Capital, LLC as an investment analyst, and then transitioning to the role of COO, Jesse Elconin began developing his finance background at Pacific Capital Bancorp, a California based regional bank that has since been acquired by Union Bank. While there, his focus of interest evolved to being a liaison for the bank’s high net worth clients. Thereafter, Mr. Elconin...

Expand BioPrior to joining the Urban Group of Companies and DRU Capital, LLC as an investment analyst, and then transitioning to the role of COO, Jesse Elconin began developing his finance background at Pacific Capital Bancorp, a California based regional bank that has since been acquired by Union Bank. While there, his focus of interest evolved to being a liaison for the bank’s high net worth clients. Thereafter, Mr. Elconin narrowed his scope to the real estate sector working for Oasis Realty, a real estate investment, brokerage and property management firm. At Oasis Realty, he handled the company’s asset management and accounting needs.

At Del Rey, Jesse’s main areas of focus are managing the company’s national, growing commercial portfolio which Del Rey intends to grow to 10,000 plus units by 2020, underwriting new commercial and residential acquisitions, overseeing the company’s financial reporting, forecasting, analysis and investor reporting.

Jesse is a graduate of California State University, Northridge with a Bachelor of Science in Finance and licensed with the California Bureau of Real Estate.

Collapse Bio

Keith Moore founded Boustead Securities (then called Monarch Bay), in 2006. Prior to Boustead, he founded numerous technology and service companies. Throughout his career Mr. Moore has served in various executive capacities from micro-cap to Russell 1000 companies, including Activision, Inc., and POPcast Communications Corp. Mr. Moore has raised over $100 million for these organizations and has grown collective...

Expand BioKeith Moore founded Boustead Securities (then called Monarch Bay), in 2006. Prior to Boustead, he founded numerous technology and service companies. Throughout his career Mr. Moore has served in various executive capacities from micro-cap to Russell 1000 companies, including Activision, Inc., and POPcast Communications Corp. Mr. Moore has raised over $100 million for these organizations and has grown collective revenues in excess of $600 million.

From 1996 through 2007, Mr. Moore served in Chief Executive and other executive capacities for POPcast Communications Corp. and iTechexpress, Inc., overseeing their respective strategic growth and capital raises. From 1991 through 1996, Mr. Moore served as President, Chief Operating Officer, Chief Financial Officer, Director and Consultant of Activision, Inc. (NASDAQ: ATVI), recognized as the international market leader in videogames. Mr. Moore was a founder of International Consumer Technologies Corp. and was Vice President, Chief Financial Officer and Director since its inception in July 1986 until its merger into Activision in

December 1991.

Mr. Moore earned a B.S. in Accounting and a Masters in Finance from Eastern Michigan University. He holds FINRA Series 7, 63, 24, 79 and 99 licenses.

Collapse Bio

Brian Park founded FlashFunders, Inc. (now known as Sutter Securities Group, Inc.) in 2013 and currently serves as a Managing Director. Sutter Securities Group has four wholly owned subsidiaries including, Sutter Securities Clearing, LLC, a FINRA member Broker-Dealer & Clearing Firm, FlashFunders Funding Portal, LLC, a FINRA member Funding Portal, FlashFunders Shareholder Services, LLC, an SEC Registered...

Expand BioBrian Park founded FlashFunders, Inc. (now known as Sutter Securities Group, Inc.) in 2013 and currently serves as a Managing Director. Sutter Securities Group has four wholly owned subsidiaries including, Sutter Securities Clearing, LLC, a FINRA member Broker-Dealer & Clearing Firm, FlashFunders Funding Portal, LLC, a FINRA member Funding Portal, FlashFunders Shareholder Services, LLC, an SEC Registered Transfer Agent, and Initiate Advisors, LLC, an SEC Exempt Reporting Adviser. In 2017, FlashFunders, Inc. was acquired by Boustead & Company Limited and Mr. Park led the transaction through its successful closing as well as the company’s integration within the Boustead firm. FlashFunders has raised over $50 million of capital on the platform to date.

Prior to founding FlashFunders and Sutter Securities Group, from 2008 through 2013, Mr. Park was an investment professional at Europlay Capital Advisors, a Los Angeles based investment firm. During his tenure, Mr. Park served various advisory roles for technology portfolio companies, including Skype, during its spinoff from eBay and subsequent sale to Microsoft. From 2006 through 2008, Mr. Park served as a Senior Associate at KPMG in its Structured Finance Group.

Mr. Park earned a B.A. in Economics from the University of Virginia and holds FINRA Series 7, 63 and 99 securities licenses.

Collapse Bio